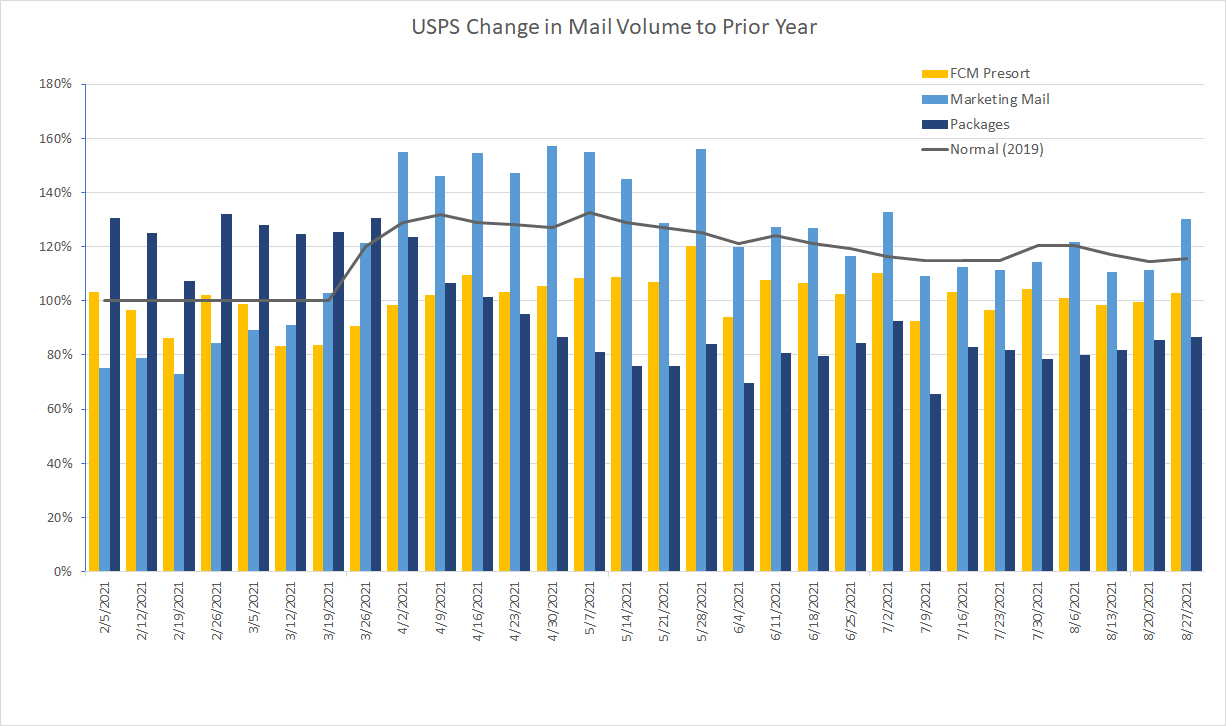

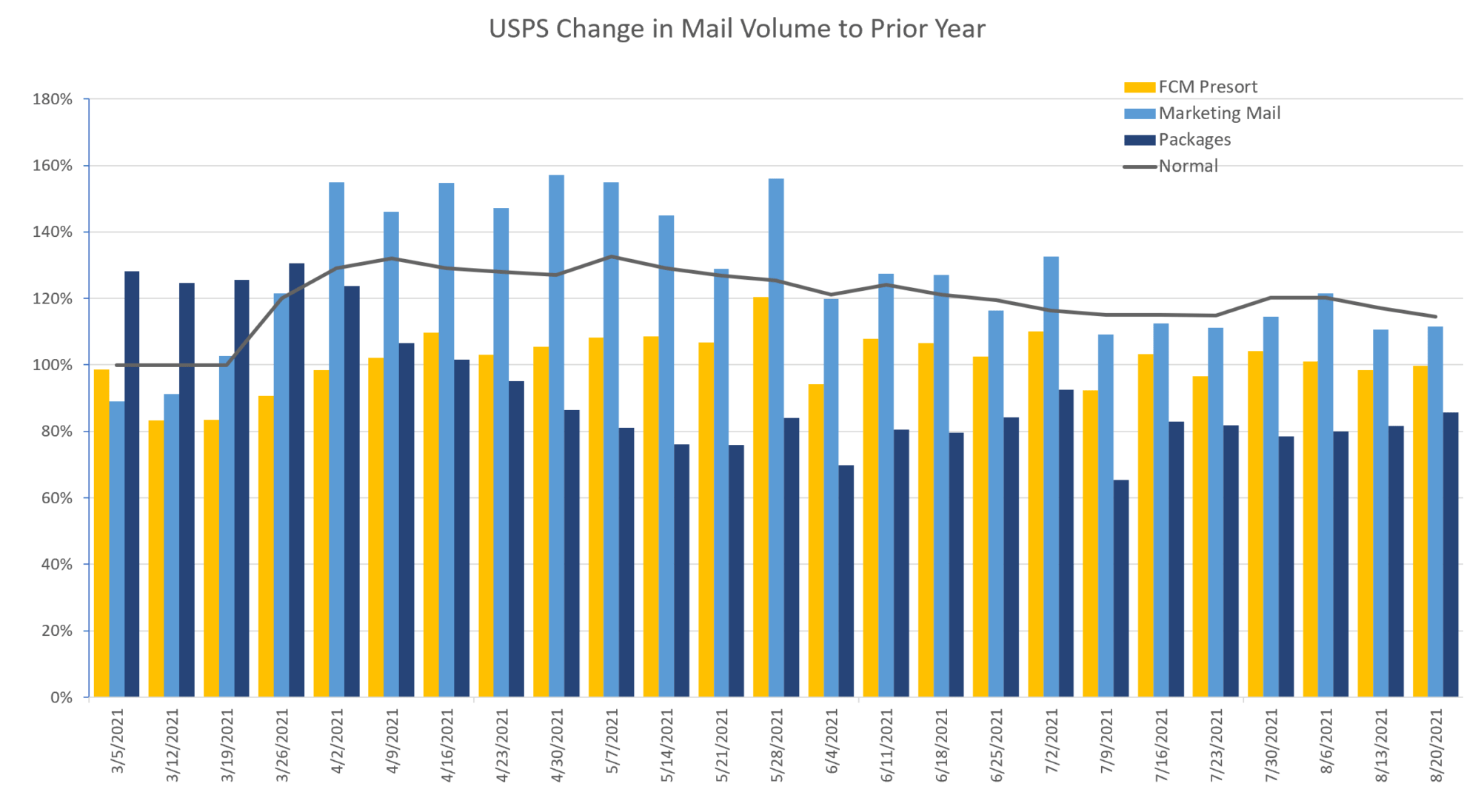

COVID Impact on Mail Volume Report – 9/17/2021

Here is GrayHair’s weekly chart on the impact of COVID on USPS Mail Volumes, as compiled by our VP of Postal Affairs, Angelo Anagnostopoulos.

For the week ending on September 17, 2021, mail inched up slightly in all categories (First-Class, Marketing, and Parcels) as it moved to return closer to 2019 volumes.

You will be able to get access to the weekly reports by following us on our big 3 social platforms: – Facebook, LinkedIn, and Twitter.

How to read this chart. The black line shows the total mail volume comparison to 2019 (for all three types). The percentage along the left-hand axis shows the percentage to the prior year’s volume with 100% being the same as the prior year.

Here is the full USPS announcement –

Here is the full USPS announcement –