By Josh McCaully, Managing Director of Solutions Architecture

From my experience, working in financial statement mailings can be a tough job.

When it comes to communicating with customers, financial institutions market electronic

statements vigorously to reduce overall costs. While they might convert 40-60% of them to online statements, they will probably hit a plateau at this number.

I have seen how frustrating this can be for large mailers. When this happens, I try to remind them that many Americans don’t trust, can’t access, or simply aren’t interested in adopting online financial services.

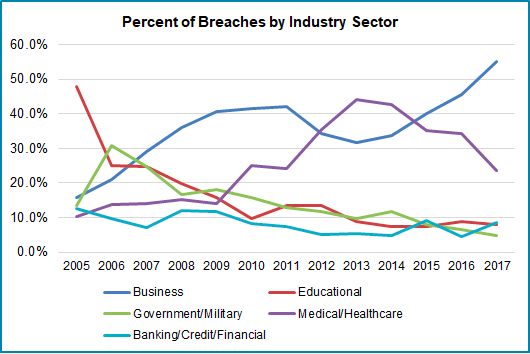

According to the Identity Theft Resource Center, the banking/credit/financial sector is the third most-breached industry with 134 reported data breaches in 2017 alone. When customers hear about a new breach every few months, many become concerned for their digital safety and look to limit the information that is available about them online – specifically when it comes to sensitive financial information.

According to the Identity Theft Resource Center, the banking/credit/financial sector is the third most-breached industry with 134 reported data breaches in 2017 alone. When customers hear about a new breach every few months, many become concerned for their digital safety and look to limit the information that is available about them online – specifically when it comes to sensitive financial information.

Others just feel comfortable paying their bills the same way they always have. A 2018 Pew Research analysis found that internet non-adoption is correlated to a number of demographic variables including age, educational attainment, household income, and rural vs. urban communities.

As such, it becomes increasingly clear that not “everyone” is online, or that at least they’re not conducting personal business there. With the direct mail industry still thriving, these are the methods I’ve found work well for improving your financial mailing strategy and increasing responses.

1. Keep convenience in mind, especially when it comes to payments.

“Sometimes, our customers receive preemptive late payment notices after they have already paid their bill – even if paying at the last minute is normal for them.”

“If a customer wishes to pay their bill by phone, they have to pay a fee to do so.”

“Many of our customers aren’t aware of how early they need to mail their payment in order for it to be received on time.”

Do any of these statements sound familiar? If so, you’re not alone, but you may be alienating customers. After all, most credit card holders have to make a payment every month and it may be the most frequent, or only, interaction they have with your company. If the process is inconvenient, you could be driving these customers away and reducing your net promoter score.

2. Communicate internally to cut through the clutter.

Most of us have had an experience where we’ve received multiple – possibly competing – mailings from the same financial institution. At best, a recipient opens each piece to determine which are relevant, but often, important statement mailings might be discarded along with a group of promotions.

Typically when we see this happen it’s because a company’s internal systems aren’t integrated, and its departments are not communicating with each other.

As a result, companies are reevaluating their identity based not just on what they do, but who they are. Some financial institutions are beginning to see themselves as tech companies that specialize in financial services, rather than the other way around. With this shift comes a greater emphasis on efficiency, user experience, and consolidated, connected systems.

While different departments may handle statements, marketing efforts, security notices, and new card distributions, enabling better internal communication will ultimately improve your customers’ experience.

3. Make the most of your statement mailings.

Coming back to the importance of collaboration, it’s surprising how many customers are willing – even eager – to learn about new products and services – but only the ones that are relevant to them.

When packaged together, statements and offers become more than the sum of their parts. An upsell can be presented as personalized, as if it’s a reward for their on-time payments and responsible card use.

What people love most about mail is the feeling of receiving something thoughtful and personal; if financial institutions can better capture this feeling, it can turn a tedious chore (paying a bill) into an opportunity for appreciation and engagement.

4. Don’t just collect data, act on it.

In 2015, the USPS Office of Inspector General issued a report that found Undeliverable as Addressed mail cost the mailing industry $20 billion a year and the USPS an additional $1.5 billion. (USPS OIG, 2015) But what do we do with this information?

Frankly, not much. Many organizations will continue sending mailings to an inactive address even after their correspondence has been returned four times or more.

This can be just as detrimental to a business as it is to a customer. Because, while the customer may have missed an important payment notice, financial organizations spend a collective $2 billion per year on undelivered mail while also exposing themselves to USPS penalties and fines.

How can you avoid this?

As a best practice, incorporate address hygiene into your mailing strategy. Updating and standardizing your lists is critical to getting mail to the right person, at the right time, and at the right address.

It’s clear that your data is trying to tell you something. By listening to and acting on it, you can increase profits, retention, and overall customer satisfaction.